Get This Report on Property By Helander Llc

Table of ContentsProperty By Helander Llc Things To Know Before You Get ThisExamine This Report about Property By Helander Llc3 Simple Techniques For Property By Helander LlcAll about Property By Helander LlcGetting The Property By Helander Llc To WorkSome Known Facts About Property By Helander Llc.

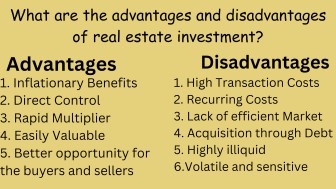

The advantages of investing in actual estate are many. Here's what you need to know regarding genuine estate advantages and why actual estate is considered a great financial investment.The benefits of buying property include easy revenue, secure capital, tax advantages, diversity, and leverage. Realty investment trust funds (REITs) provide a method to buy property without having to possess, operate, or money properties - https://property-by-helander-llc.mailchimpsites.com/. Capital is the earnings from a realty financial investment after home mortgage repayments and general expenses have actually been made.

In a lot of cases, cash circulation only enhances over time as you pay for your mortgageand construct up your equity. Genuine estate investors can take benefit of numerous tax breaks and deductions that can save cash at tax time. As a whole, you can subtract the affordable prices of owning, operating, and managing a home.

Property By Helander Llc - Questions

Realty worths tend to increase gradually, and with a good investment, you can profit when it's time to sell. Rental fees also have a tendency to increase gradually, which can cause greater cash money circulation. This chart from the Federal Reserve Bank of St. Louis reveals typical home prices in the U.S

The areas shaded in grey indicate U.S. economic downturns. Typical Prices of Residences Cost the United States. As you pay for a property home mortgage, you build equityan property that becomes part of your web well worth. And as you develop equity, you have the take advantage of to purchase even more residential properties and raise cash money flow and wealth much more.

:max_bytes(150000):strip_icc()/top-6-reasons-to-be-a-real-estate-agent-2867442-v5-5c12b4f0c9e77c0001f6e015.png)

Because real estate is a tangible property and one that can serve as security, funding is readily available. Genuine estate returns vary, depending on elements such as place, possession class, and monitoring.

The 10-Minute Rule for Property By Helander Llc

This, in turn, translates into higher funding values. Real estate often tends to preserve the purchasing power of resources by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of resources gratitude. Home mortgage borrowing discrimination is prohibited. If you believe you've been victimized based on race, faith, sex, marital condition, usage of public help, nationwide origin, disability, or age, there are actions you can take.

Indirect real estate investing includes no straight ownership of a residential property or residential or commercial properties. Instead, you buy a see this swimming pool along with others, wherein a management company has and operates buildings, or else has a portfolio of home mortgages. There are a number of manner ins which possessing actual estate can protect against inflation. Residential property worths may climb higher than the rate of inflation, leading to funding gains.

Properties funded with a fixed-rate lending will certainly see the relative amount of the month-to-month home mortgage repayments drop over time-- for circumstances $1,000 a month as a set payment will certainly become less burdensome as rising cost of living wears down the acquiring power of that $1,000. https://www.twitch.tv/pbhelanderllc/about. Commonly, a main residence is not thought about to be a property investment because it is used as one's home

Facts About Property By Helander Llc Revealed

Despite having the help of a broker, it can take a few weeks of work just to discover the best counterparty. Still, actual estate is an unique property course that's basic to comprehend and can boost the risk-and-return profile of a financier's portfolio. By itself, property supplies capital, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge against inflation.

Buying realty can be an unbelievably satisfying and lucrative venture, however if you resemble a whole lot of new capitalists, you might be asking yourself WHY you should be buying property and what benefits it brings over various other financial investment chances. In addition to all the incredible advantages that come along with spending in actual estate, there are some disadvantages you need to think about.

Getting The Property By Helander Llc To Work

If you're searching for a way to get into the property market without having to spend thousands of hundreds of dollars, have a look at our residential properties. At BuyProperly, we use a fractional ownership design that allows financiers to begin with as low as $2500. An additional significant benefit of genuine estate investing is the capability to make a high return from purchasing, refurbishing, and reselling (a.k.a.

8 Easy Facts About Property By Helander Llc Shown

For instance, if you are charging $2,000 lease each month and you sustained $1,500 in tax-deductible costs per month, you will just be paying tax obligation on that $500 earnings each month. That's a big difference from paying taxes on $2,000 monthly. The earnings that you make on your rental unit for the year is thought about rental revenue and will certainly be tired accordingly